In recent posts, we’ve discussed student debt, rising tuition, competency-based credit, technology in education, and accountability for graduation rates and debt load, among other topics. Well, it turns out that Obama has been reading some of the same blogs we have. His education plan, introduced last week, includes several proposals relating to these very issues. Let’s take a look at them, starting today with student debt.

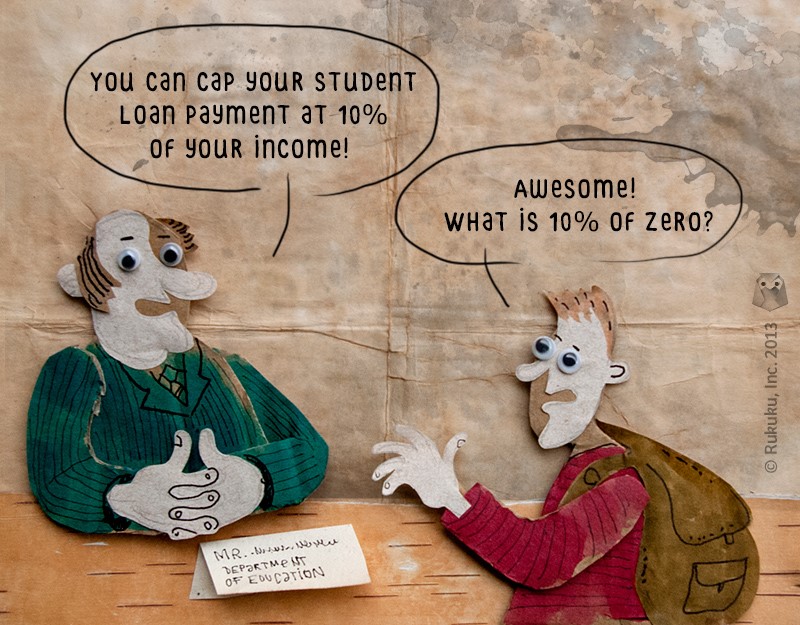

The plan calls for an expansion of the Pay-As-You-Earn plan, which caps monthly student debt payments at 10% of income, with loans forgiven after 20 years, or 10 years for those working in the public sector. The original law setting the precedent for this was passed back in 2007, with the caps lowered to 10% and time until forgiveness shortened last year from 25 to 20 years.

Obama’s Pay-As-You-Earn program allows recent graduates to limit their monthly student loan payments to 10% of monthly income

At the moment, only students that took out their first loans after 2008 and their most recent loans after 2011 are eligible for the Pay-As-You-Earn program. Obama wants to expand the program to include all federal student loan borrowers. So far, only 2.5 million of 37 million federal borrowers are enrolled in income-based repayment programs, including the previous versions. Part of the reason is eligibility. Another part is awareness.

Many borrowers don’t know that they qualify for lower payments. For that reason, as another part of Obama’s plan, the government will spend money to teach graduates to save money through these programs. Maybe the government can advertise them on twelve packs of cheap beer.

I don’t mean to imply that all indebted, recent college grads are sitting around drinking cheap beer. I mean to imply that I sat around drinking cheap beer when I was recently graduated and in debt. I am sure some recent grads are still doing that.

I am also sure some recent grads are struggling to move beyond part-time jobs at restaurants and retail stores and into career-building work. Some less recent grads are, too. Those transitions into better paying jobs take time, especially in a weak job market, and a 10% cap on loan payments will help during that process.

The awareness campaign will focus on educating guidance counselors and tax specialists, as well as graduates with debt. They may need it. I had a hard time understanding some details, especially in relation to earlier versions of the plan. This proposal may do away with those earlier versions. Or maybe it won’t. See, I’m not clear on this.

To better explain such details, the Department of Education will set up “one-stop shops” with resources on the income-based payment plans. The challenge will be to keep those shops up-to-date and motivated to get the message out. It would be easy to set up a booth on campus and sit around drinking smoothies all day. I don’t mean to imply that all Education Dept. employees like smoothies. I mean to imply that I like smoothies.

In our next post, we’ll look at loan forgiveness and some mild moral hazard.