Education was big in Obama’s annual State of the Union address. In fact, he opened the speech by praising the work of teachers and boasting about the graduation rate, now at its highest level in decades. He then went on to discuss several education-related issues, ranging from pre-K to student debt to skills training to broadband access.

None of it was new really, but the good thing about having a congress that doesn’t pass anything is that you don’t need so many new ideas, just push a little harder on the old ones. For supporters of those ideas, Obama’s continued commitment comes as good news, even if it’s not new news.

For me, two statements in particular stood out. First, Obama repeated a 2013 pledge to connect 99% of students to broadband internet in the next four years. As an education internet start-up, we obviously liked that news. To accomplish that, the administration plans to work with the FCC and companies like Apple, Microsoft, Sprint, and Verizon, he said.

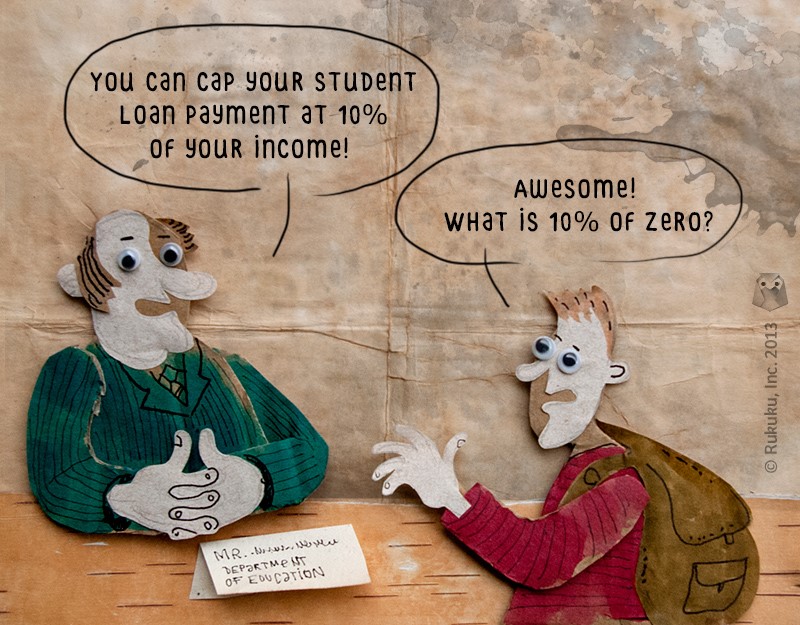

Second, Obama mentioned plans for the US Treasury and Education Departments to team up with accounting software company Intuit to better educate students and recent grads on how loan repayments work and what options they have. We’ve written quite a bit about student debt in this blog and are all about young adults getting some help on that front.

I was happy to hear about both of these proposals, but that’s not why they stood out to me. I found them interesting because, in both cases, Obama navigated around Congress by seeking out support from the private sector. In 2013, Congress had its least productive year in recent history. With that in mind, it seems reasonable for Obama to explore other options.

Still, the approach warrants some scrutiny. As appealing as these two ideas are, I do wonder if we are opening up another avenue for corporate sponsorship. If so, does it matter? What would a presidential shout-out in an advertisement-free, State of the Union address be worth?

I don’t mean to be overly critical. I think it’s cool that these companies are helping out and that the administration can move forward on this without adding anything to the deficit and without struggling through Congress. The relationships between corporations and governments are made of powerful stuff, though, and we should be conscious of that power, even when it’s contributing to worthy causes.