As anyone who reads this blog knows, the cost of education is an important topic for us. One of our goals is to expand the number of education options for everyone in the entire world. Lots of people are trying to do similar things, especially those in the movement to have more open source educational material.

Those folks are getting some support from two US senators. Senator Dick Durbin of Illinois and Senator Al Franken of Minnesota have proposed a bill to offer public funding for the creation of education textbooks on the condition that the material then be offered free of charge.

Here’s what Senator Franken said about the bill. “I’m proud to introduce this bill because it will help provide cheaper alternatives to traditional textbooks and keep more money in students’ pockets, where it belongs.” Here is what Al Franken said when he used to be an actor on Saturday Night Live. I bet he’s proud of that, too.

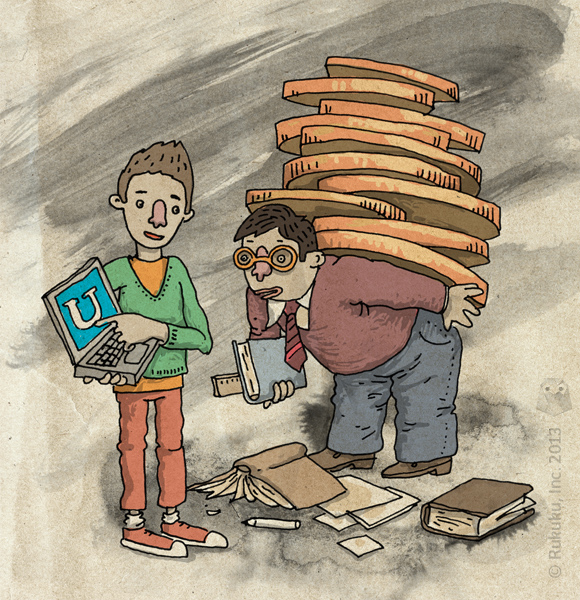

Textbook costs are more significant than one might think. The average student at a four year public university spends about $1200 per year on textbooks, according to the College Board. Since 1978, the cost of textbooks has risen 812%, according to this analysis from Mark Perry of the American Enterprise Institute. That is higher than the growth rate for healthcare, real estate, and general consumer prices.

The high costs translate into big business for education publishers as well as textbook renters and re-sellers. They are reluctant to cede that market to the open source movement. That does not mean they are not preparing. The three largest publishers, London-based Pearson, New York-based McGraw-Hill, and Boston-based HoughtonMifflin Harcourt, are all working on digital content strategies. Check out more about that in this great article by Michelle Davis at Education Week.

In terms of the Senate bill to fund textbook creation, I can see a potential problem. I am no hardcore capitalist or anything, but if the funding comes without regard to how often the textbooks are used, then the authors lose some incentive for making engaging, high quality content. They don’t need to be as competitive. That may or may not be a problem. Time will tell.

On the positive side, the increasing use of electronic formats for e-readers and laptops could reduce textbook costs further and expand the reach of free educational content. The benefits could easily overflow the borders of the US, helping students around the world.

At Rukuku, we’ve done our best to make content creation as painless as possible. Our Composer feature allows teachers to simply cut and paste text, graphics, and video into class worksheets.

The trend, regardless of whether this bill passes or not, is toward open resources. Composer can help teachers organize those free resources into class materials. Those materials can then be shared, or possibly even sold, on Rukuku’s Marketplace.