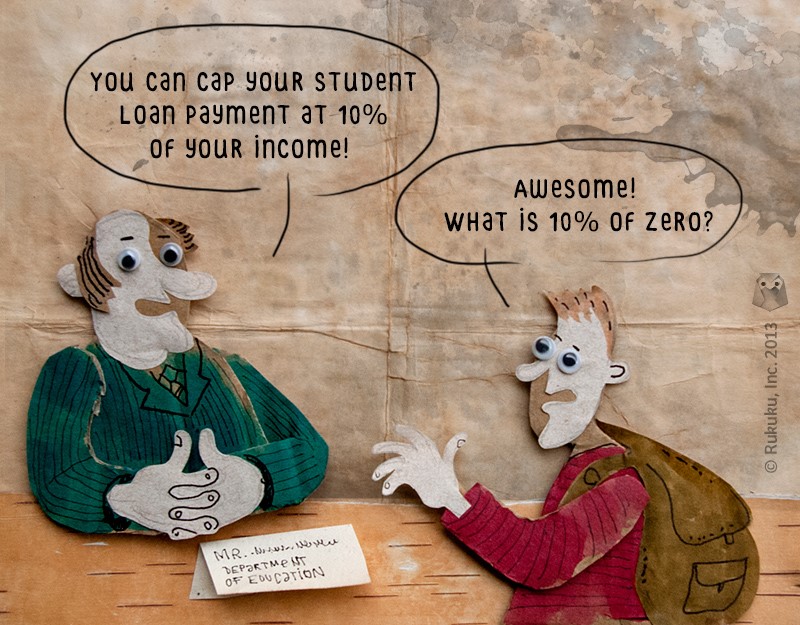

In our most recent posts, we looked at Obama’s proposed higher education reform and its provisions for limiting student loan payments and in some cases forgiving debts. Those policies are relatively straight forward, despite a few challenges we highlighted.

The most central and more complicated part of Obama’s education plan relates to its college ranking system. For this, the Department of Education will rank universities and colleges based on several factors including graduation rate, loan default rate, average debt loads, and graduate employment rates.

Eventually, these rankings will influence the awarding of federal money for student tuition. In other words, schools that offer better deals for students will get more investment from the federal government.

It sounds reasonable enough for an investor to evaluate the potential returns. In this case, that investor is the federal government, on the one hand, and the incoming student, on the other. In both cases, knowing more about these rates should be important. This reform will make that information widely available, something that is not the case currently, as we’ve discussed in previous posts.

The more challenging part of the ranking process will be determining the proper weight of each element of the criteria without making them vulnerable to manipulation or disadvantaging schools that may be doing good things that are tougher to quantify. For example, low income students, even those with high test scores, are less likely to complete college.

Check out this graphic below, taken from this excellent 2012 blog post by Elise Gould, of the Economic Policy Institute: http://www.epi.org/blog/college-graduation-scores-income-levels/

Colleges then will have to weigh the advantages given in the ranking to assisting low-income students against the disadvantages of a possible decrease in the graduation rate. That could discourage universities from recruiting lower income students or really any students with higher risks of dropping out.

This doesn’t have to be the case, but the Department of Education must be careful when it evaluates and assigns values to the various pieces of the magical equation that will determine rankings.

That being said, the most influential aspect of this plan, at least early on, will likely be its emphasis on transparency. It is important to have this information easily available and just as important that colleges are aware that it is easily available. That will give them incentive to improve in these categories.

Taking the next step, though, and using that information to come up with a specific rank for each school could result in some unintended consequences, especially when tied directly to funding. Schools will have strong incentives to massage their numbers, and the Department of Education must be very careful to minimize the possibilities for them to do so.